The insurance market is rapidly evolving. Providers are integrating Artificial Intelligence (AI) to take advantage of the explosion of data emerging from connected devices, smart cities, and the changing relationships between humans and technology.

Mind Foundry and Aioi Nissay Dowa Europe (AND-E) have been working together to drive digital transformation throughout a number of their business lines and departments.

Throughout this report we will look at:

-

The four myths around AI adoption

-

AI in action at AND-E

-

The future of AI in insurance

-

Going from Artificial Intelligence to Organisational Intelligence

AI Myths

Kicks off by discussing four commonly believed myths of working with AI:

- Myth: AI is not compatible with a highly regulated environment

- Myth: Success with AI is only available to disruptive business models

- Myth: An automation roadmap will bring about organisational change

- Myth: If you adopt AI today, you don’t have to think about tomorrow

Find out why these myths should be busted.

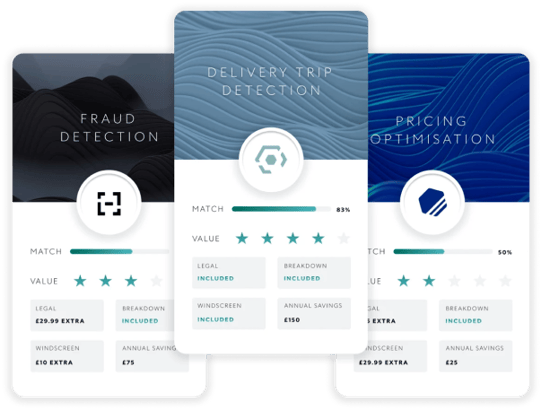

3x Use Cases

Nika Lee, UK Chief Underwriting Officer at AND-E, discusses the ROI from the most powerful use cases for the responsible use of AI in insurance including:

-

120% improvement in fraud detection rates in the first month

-

95% precision of classification models in detecting delivery trips

-

Improved understanding of risk creating value through pricing optimisation

Future of Insurance

It's an exciting time to be bringing AI to insurance. Warren Hetz, UK CEO at AND-E paints a picture of the rapidly evolving future of insurance:

-

How to achieve success by creating a collaborative approach between humans and AI

-

How the future of claims, service, underwriting, and pricing will be reshaped by AI

-

How to generate better value and experiences for customers

-

How to up-skill your whole team, not just the data scientists, to gain an intuition for how to work with AI

Organisational intelligence

Brian Mullins, CEO at Mind Foundry, concludes the webinar with a thought-provoking discussion about what's next for AI in insurance and other industries that need to solve high-stakes problems responsibly.

-

Will AI 'wake up'?

-

Does a superintelligence already exist?

-

Why is it important to go from Artificial Intelligence to Organisational Intelligence?

5 min read

Fighting Fraud in Typhoon Season

by Nick Sherman

4 min read

AI Insights from Insurance Leaders in 2024

by Mind Foundry

Stay connected

News, announcements, and blogs about AI in high-stakes applications.