Gain an edge, and improve upon it day after day

An AI-powered fraud solution that enables insurers to stay one step ahead of fraudsters’ constantly evolving techniques.

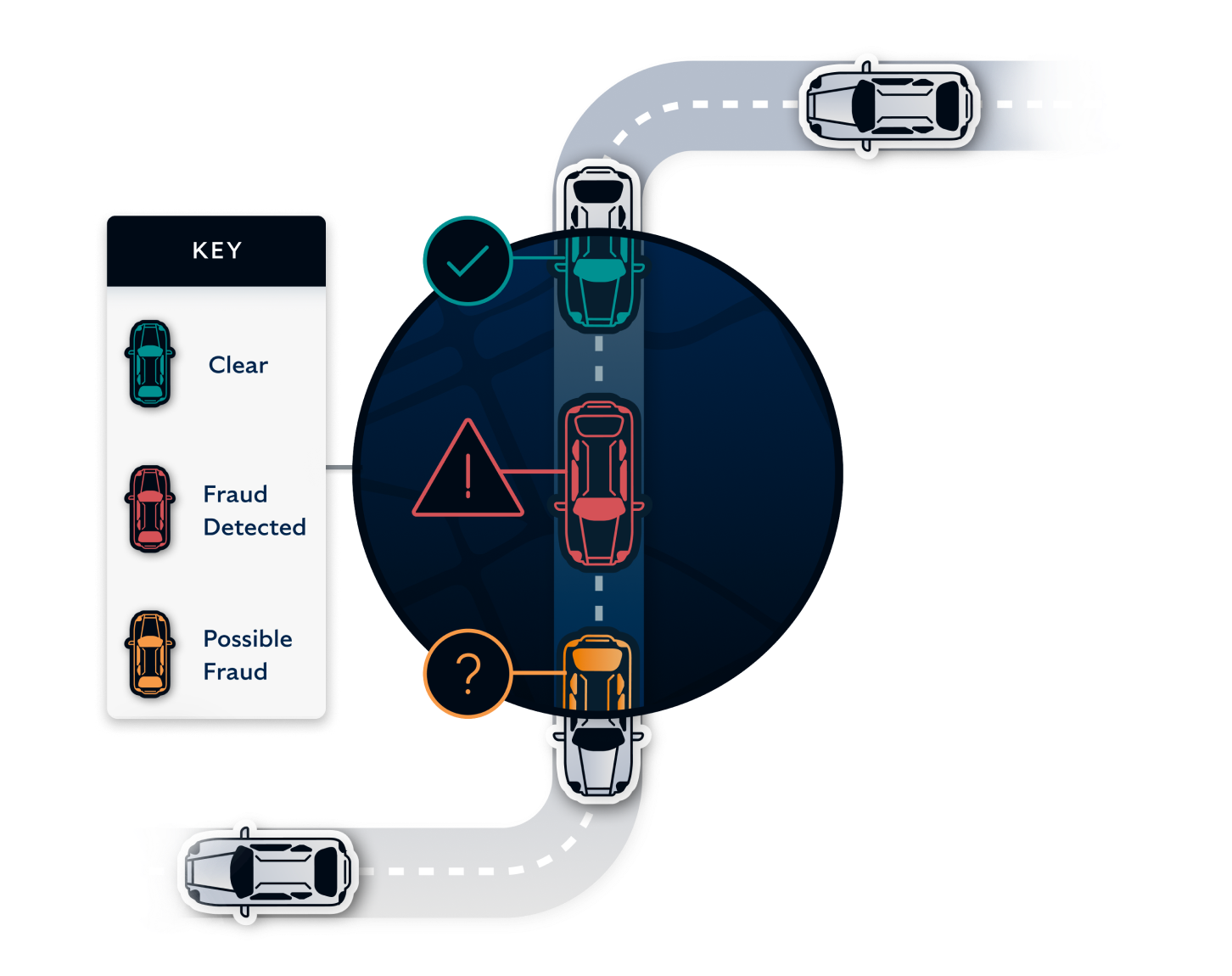

Fraud, in all its forms

Fraud happens everywhere, and takes on many shapes and sizes. Our AI can spot the patterns of fraud, no matter how subtle.

AI that works for you

Complex customised model features are designed to meet the unique requirements of the problems that matter most to you.

AI that gets better

Continuous Metalearning improvements automatically push your models performance beyond day-one capability as new trends are detected.

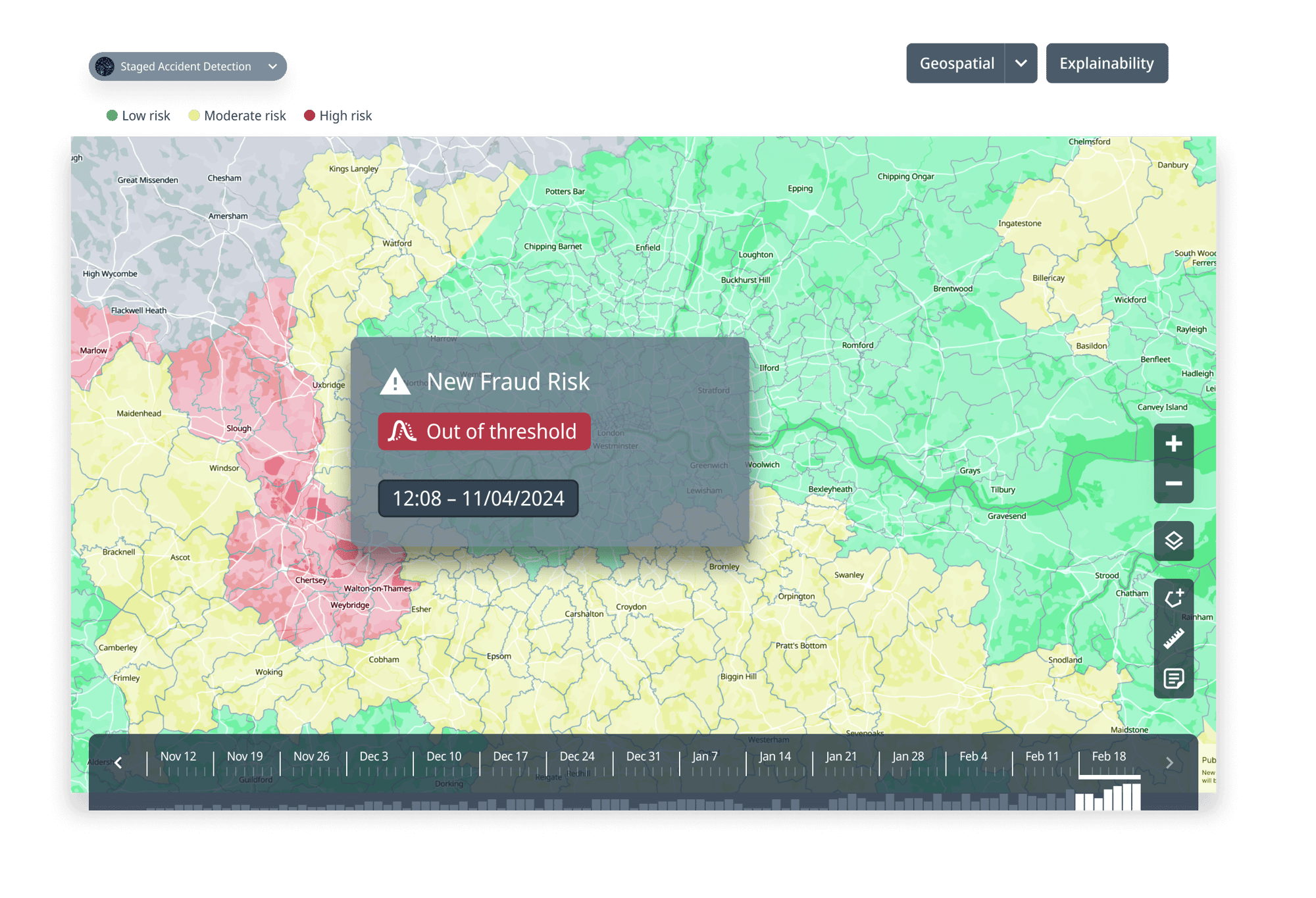

Detect fraud in a constantly shifting landscape

From traditional claims with customers to fraud syndicates or disputes with repairers, our proprietary algorithmic architecture achieves unparalleled accuracy, with parameters optimised to the unique types of fraud you’re targeting. As new patterns emerge, continuously integrate this data back into the solution to find similar cases and evolve performance over time.

Powered by Mind Foundry Core.

Boost your fraud team’s efficiency

Close cases faster with intelligent prioritisation and investigation features. AI can prioritise each unique case, using new and previously learnt features, including hand-written notes, phone numbers, registrations, and more. Handlers can then search for similar features, accelerating the ability to close each investigation quicker, accompanied by reports, supporting evidence, and investigator notes.

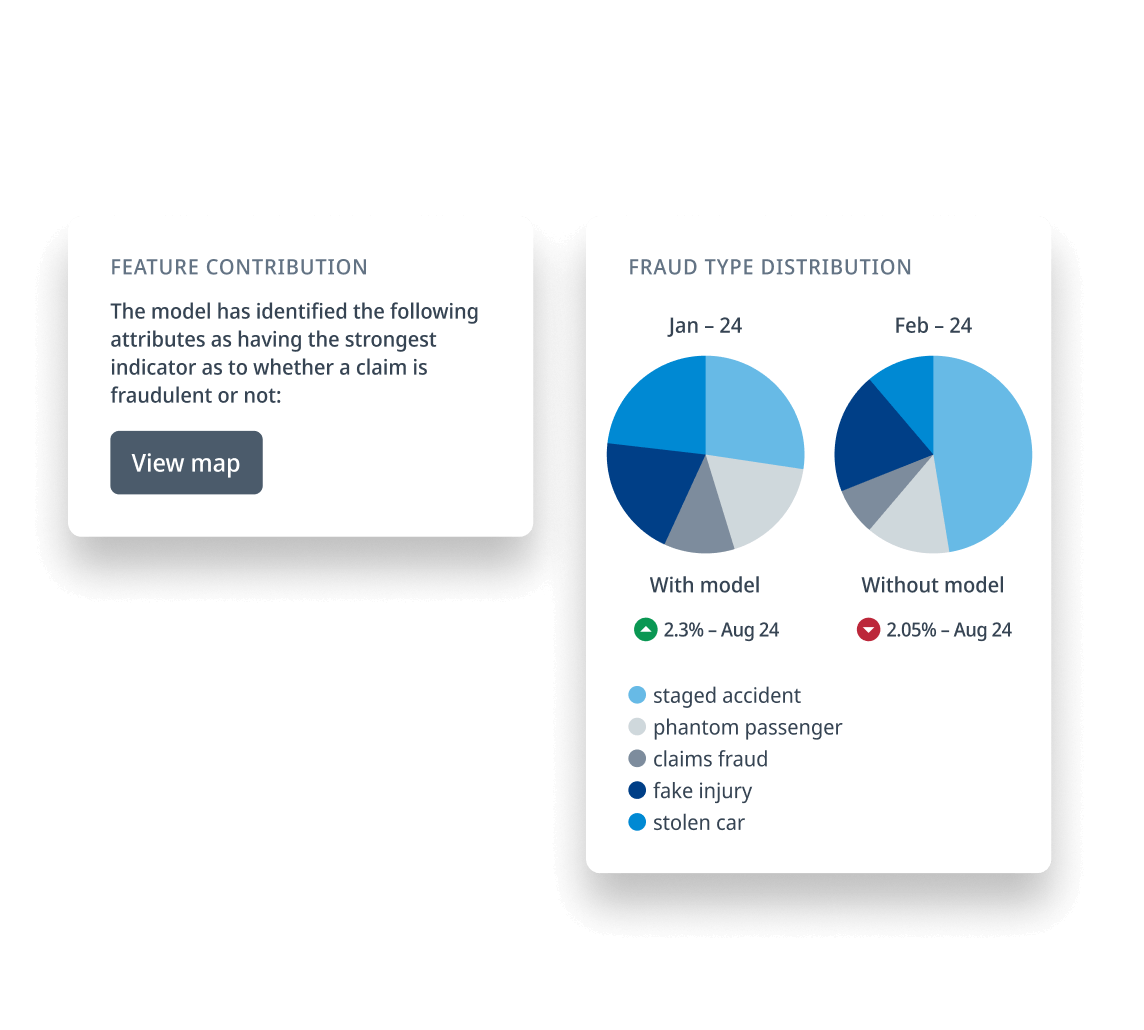

Fairness and transparency, by design

Build trust as you implement advanced AI models with controls to preserve and monitor fairness, eliminate unwanted biases, and ensure transparency in decisions.

Powered by Mind Foundry Motion.

Worry-free governance as you scale AI

Implement a robust model governance framework that ensures accountability, compliance, and ethical use of AI algorithms, adhering to industry standards and regulations.

Powered by Mind Foundry Motion.

.png?width=2000&name=Fraud%20Motion%20(1).png)

We know you’re not the same as other insurers

Unlike most off-the-shelf solutions, the Mind Foundry Platform empowers you with the only AI Platform for building, operationalising, and scaling AI that gets better over time.

Research has shown that 91% of models decay after the first year as new data is introduced and the world continues to change. Retraining underperforming models helps, but incurs significant OpEx costs. We won’t let this happen to you. Our solutions come with Continuous Metalearning capability, which means the solution automatically and continuously integrates data to improve performance. Instead of getting worse over time, it gets better.

How it works

.png?width=2952&height=1816&name=Frame%202402%20(1).png)

Features:

-

Investigations dashboard

-

Real-time fraud detection

-

Continuous Metalearning capability

-

Seamless integration with core and third-party systems

-

Algorithmic transparency

-

Incorporates structured and unstructured data

-

Direct bottom-line savings

-

Reduces false positives

-

Proactive case monitoring

-

Feature explainability

-

KPI monitoring

-

Extensible workflows

-

Unified search capability

-

Instant ROI, reduced total cost of ownership

-

Manage parameters of the product

-

Model governance framework

-

Responsible AI tests

-

User-defined alerts

-

Multi-source data

-

Natural language processing

-

Optical character recognition

-

Extensible workflows

-

Proactive case monitoring

-

Downloadable reports

-

Deployment in 30 days

-

Customer support

.png?width=1000&height=614&name=Frame%202402%20(1).png)

-

Investigations dashboard

-

Real-time fraud detection

-

Continuous Metalearning capability

-

Seamless integration with core and

third-party systems -

Algorithmic transparency

-

Incorporates structured and unstructured data

-

Direct bottom-line savings

-

Reduces false positives

-

Proactive case monitoring

-

Feature explainability

-

KPI monitoring

-

Extensible workflows

-

Unified search capability

-

Instant ROI, reduced total cost of ownership

-

Manage parameters of the product

-

Model governance framework

-

Responsible AI tests

-

User-defined alerts

-

Multi-source data

-

Natural language processing

-

Optical character recognition

-

Extensible workflows

-

Proactive case monitoring

-

Downloadable reports

-

Deployment in 30 days

-

Customer support

Case Study

Reducing the cost of fraudulent claims

Mind Foundry built a unique fraud detection and prediction solution based on Aioi Nissay Dowa Europe's specific requirements that could not be met by any off-the-shelf solutions. The Mind Foundry Platform empowered claims experts to identify, prioritise, and investigate fraudulent activity.

As new patterns emerge, using Motion, the solution automatically and continuously integrates data back into the model to improve performance over time rather than suffer model failure. New risks can be effectively governed while enabling the model to learn new types of fraud in production. Results include:

- Increased referrals retained by the fraud department by 800%, so handlers spent less time on false positive cases.

- Increased the detection of fraudulent claims by 120% compared to the legacy system.

- Saved 2% on capped indemnity spend in 2022 and tracking to double that in 2023 with a 4% saving.

"Mind Foundry’s fraud solution enabled AND-E to improve fraud detection by 120% within the first month of adoption, compared to our traditional system. We expect this to continue improving as the model continuously learns and we expand our partnership. This is hugely beneficial to both AND-E and our customers, helping us to eliminate more fraudsters and become more competitive by reducing the cost of fraud being passed onto our customers."

Greg Cole

UK Claims Director

8 min read

AI vs Fraud in the UK and Japan

Nick Sherman:

5 min read

Why AI Governance Matters in the Fight against Insurance Fraud

Mind Foundry:

Stay connected

News, announcements, and blogs about AI in high-stakes applications.