Supercharge your pricing with AI

An insurance pricing engine that enables you to create and manage powerful pricing decisions you can understand and explain to technical and non-technical stakeholders.

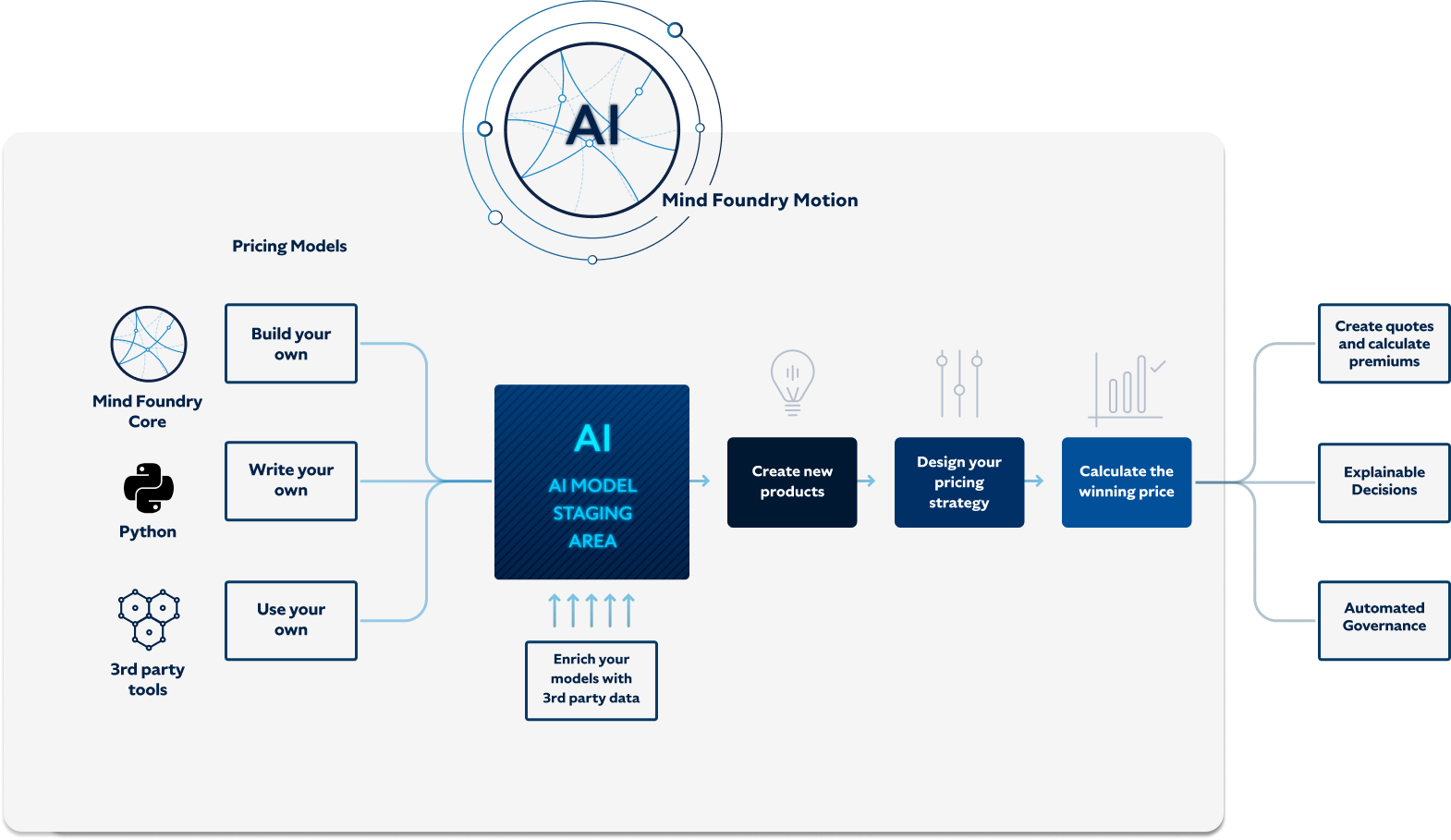

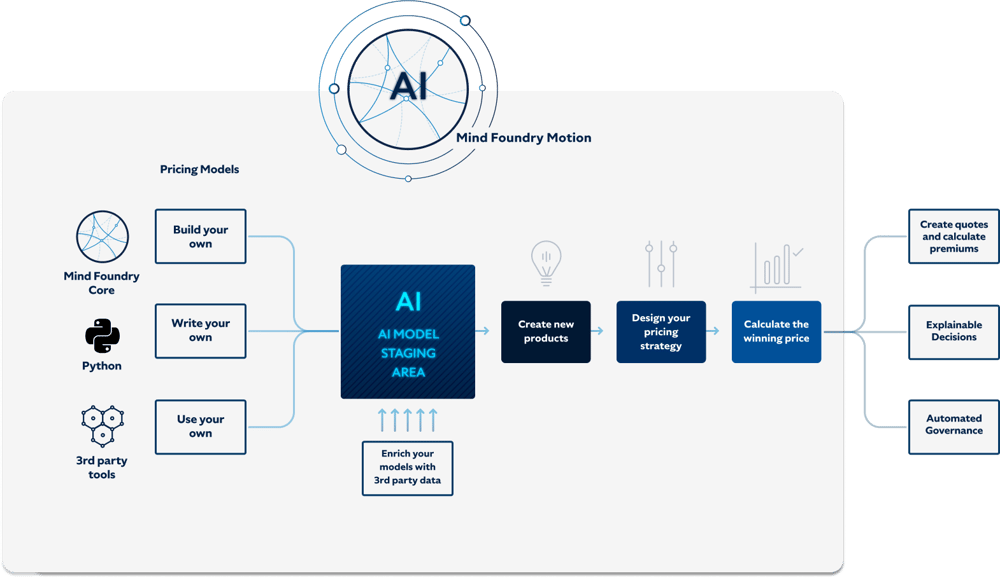

Connect all your models

Connect complex AI models, including those made in Python, 3rd party tools, or by Mind Foundry Core with all your risk models, to have one view.

Build pricing formulas

Work faster and more efficiently with self-service drag and drop pricing formulation, including the ability to add non-linear models as fields, designed in an intuitive interface.

Monitor and improve

Outperform competitors by automating the governance, retraining and metalearning capability of your pricing models without sacrificing performance.

Build, deploy, and enhance state-of-the-art AI pricing models

Harness the power of the latest machine learning algorithms and predictive analytics, enriched by third party data to accurately assess risk and determine optimal insurance pricing.

Powered by Mind Foundry Core.

.png?width=2000&name=BuildPricingModels%20(1).png)

Boost your pricing team’s efficiency

Feeding the outputs of your AI models directly into pricing models is time-consuming and difficult, but can significantly increase performance. Our self-service pricing formulation dashboard makes it easy for pricing managers to combine non-linear models with other linear factors to give customers the most competitive rate, whilst being easy to navigate, customise, and explain.

.png?width=2000&name=CreateGuarantees%20(1).png)

Fairness and transparency, by design

Build trust as you implement advanced AI models with controls to preserve and monitor fairness, eliminate unwanted biases, and ensure transparency in pricing decisions.

Powered by Mind Foundry Motion.

.png?width=1848&height=1086&name=Fairness%20by%20design%20(1).png)

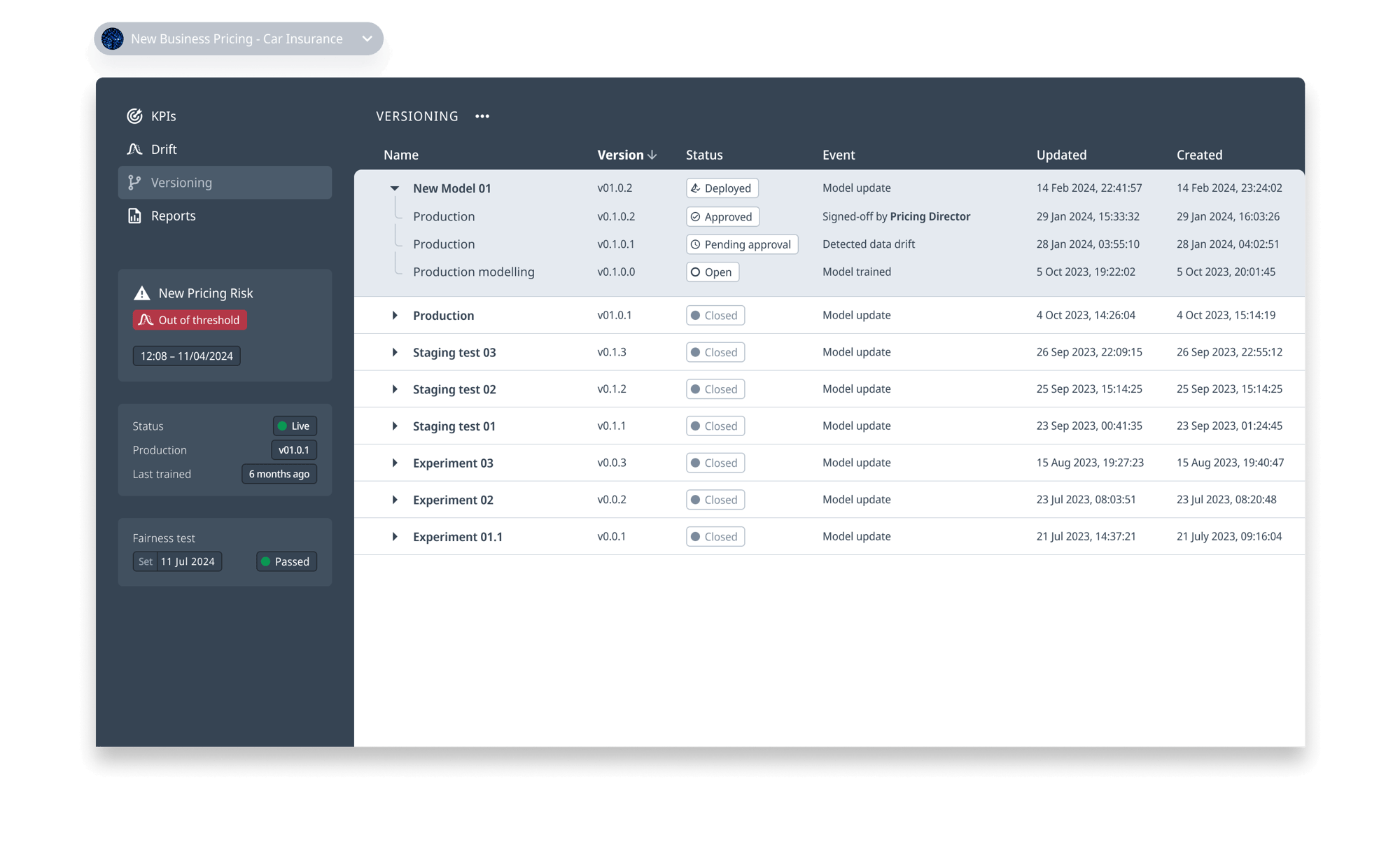

Worry-free governance as you scale AI

Implement a robust, platform agnostic model governance framework that ensures accountability, compliance, and ethical use of AI algorithms, adhering to industry standards and regulations.

Powered by Mind Foundry Motion.

We know you’re not the same as other insurers

Unlike most off-the-shelf solutions, the Mind Foundry Platform empowers you with the only AI Platform for building, operationalising, and scaling AI that gets better over time.

Research has shown that 91% of models decay after the first year as new data is introduced and the world continues to change. Retraining underperforming models helps, but incurs significant OpEx costs. We won’t let this happen to you. Our solutions come with Continuous Metalearning capability, which means the solution automatically and continuously integrates data to improve performance. Instead of getting worse over time, it gets better.

How it Works

Features:

-

Continuous Metalearning capability

-

Integrations with third-party systems

-

Algorithmic transparency

-

Incorporates structured and unstructured data

-

Customer support

-

Unified search capability

-

Multi-source data

-

Extensible workflows

-

Proactive case monitoring

-

Feature explainability

-

KPI monitoring

-

Pricing engine calculator

-

Make quote calculations

-

Connect to risk models

-

Self-service pricing forumlation

-

Manage parameters of the product

-

Create new insurance pricing products on your own

-

Model governance framework

-

Responsible AI tests

-

User-defined alerts

-

AI model staging area

-

Downloadable reports

-

Continuous Metalearning capability

-

Integrations with third-party systems

-

Algorithmic transparency

-

Incorporates structured and unstructured data

-

Customer support

-

Unified search capability

-

Multi-source data

-

Extensible workflows

-

Proactive case monitoring

-

Feature explainability

- KPI monitoring

-

Pricing engine calculator

-

Make quote calculations

-

Connect to risk models

-

Self-service pricing forumlation

-

Manage parameters of the product

-

Create new insurance pricing products on your own

-

Model governance framework

-

Responsible AI tests

-

User-defined alerts

-

AI model staging area

-

Downloadable reports

.png?width=487&height=500&name=Pricing%20case%20study2%20(1).png)

Case Study

Enhancing pricing models with Aioi Nissay Dowa Europe

Using the Mind Foundry Platform, we developed a unique solution that incorporates millions of data points from multiple disconnected sources. The solution combined historic renewal cases, including the outcome at given price points and true cost to AND-E, with competitor price estimations.

The solution enables AND-E to have a deeper, data-driven understanding of a potential customer’s risk profile whilst using this insight to simultaneously predict the market price.

The solution enables better risk estimation for renewal quotes, which has led AND-E to retain 1-2% more of their best customers. Renewing customers is far better for AND-E than new business as they come with a clear picture of risk.

"We saw greater engagement and collaboration between pricing experts and data scientists, collaborating throughout the model deployment and use. As a business, it was another step towards the responsible use of AI with transparency, accountability, and human oversight."

Jon Wilshire

Chief Underwriting Officer

4 min read

7 Steps for Scaling AI Governance in Insurance Pricing

by Mind Foundry

6 min read

Why Insurance Pricing Needs AI Governance

by Mind Foundry

Stay connected

News, announcements, and blogs about AI in high-stakes applications.