AI-enabled Acoustic Intelligence for Counter-UAS

Unmanned Aircraft Systems (UAS) are now a staple of modern warfare, now responsible for 60% of targets destroyed in the Ukraine-Russia war....

The integration of Artificial Intelligence (AI) and machine learning has already brought transformative opportunities across the rapidly evolving landscape of the insurance industry. As data generation has surged and competition intensified, insurers have recognised AI’s game-changing potential as a tool for analysing expansive volumes of data with unprecedented speed and accuracy. With data generation occurring at such high velocity, insurers turned to AI as a series of experiments to make sense of this complexity and respond to the ever-increasing external shocks in the insurance market. But with expanded adoption comes a swathe of new and pressing concerns, and with AI advancements showing no signs of slowing, the insurance industry needs to consider the technological solutions that will tackle both the problems of today and the challenges of tomorrow.

The Perfect Solution?

Machine learning adoption in insurance began in the 2010s and was initially promising, with insurers building ad hoc models to gain insights and stay ahead in the market. These tentative experiments seemed like the perfect solution at first - a chance to unlock the advantages of intellectual property and data retention while having the reliability of software-driven processes. As insurers started to lean into the potential of AI, senior leaders were hopeful that these models would revolutionise insurance operations, improve underwriting accuracy, enhance customer service, and optimise risk management.

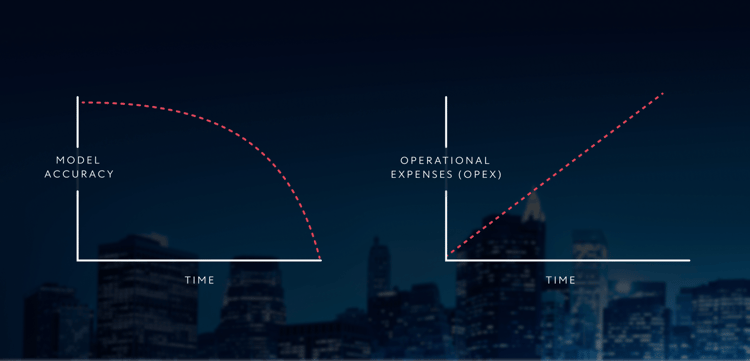

However, these insurers quickly encountered unforeseen challenges. These challenges had many different causes, but the overarching reason for insurers’ struggles was that they were adopting AI without a cohesive strategy. This is a problem that remains pervasive in the insurance industry to this day, and managing these ad hoc models continues to be a complex task, often leading to hidden increases in operational expenses (OpEx). Each model requires individual maintenance, consuming time and resources and making them an opportunity cost for the core business focus.

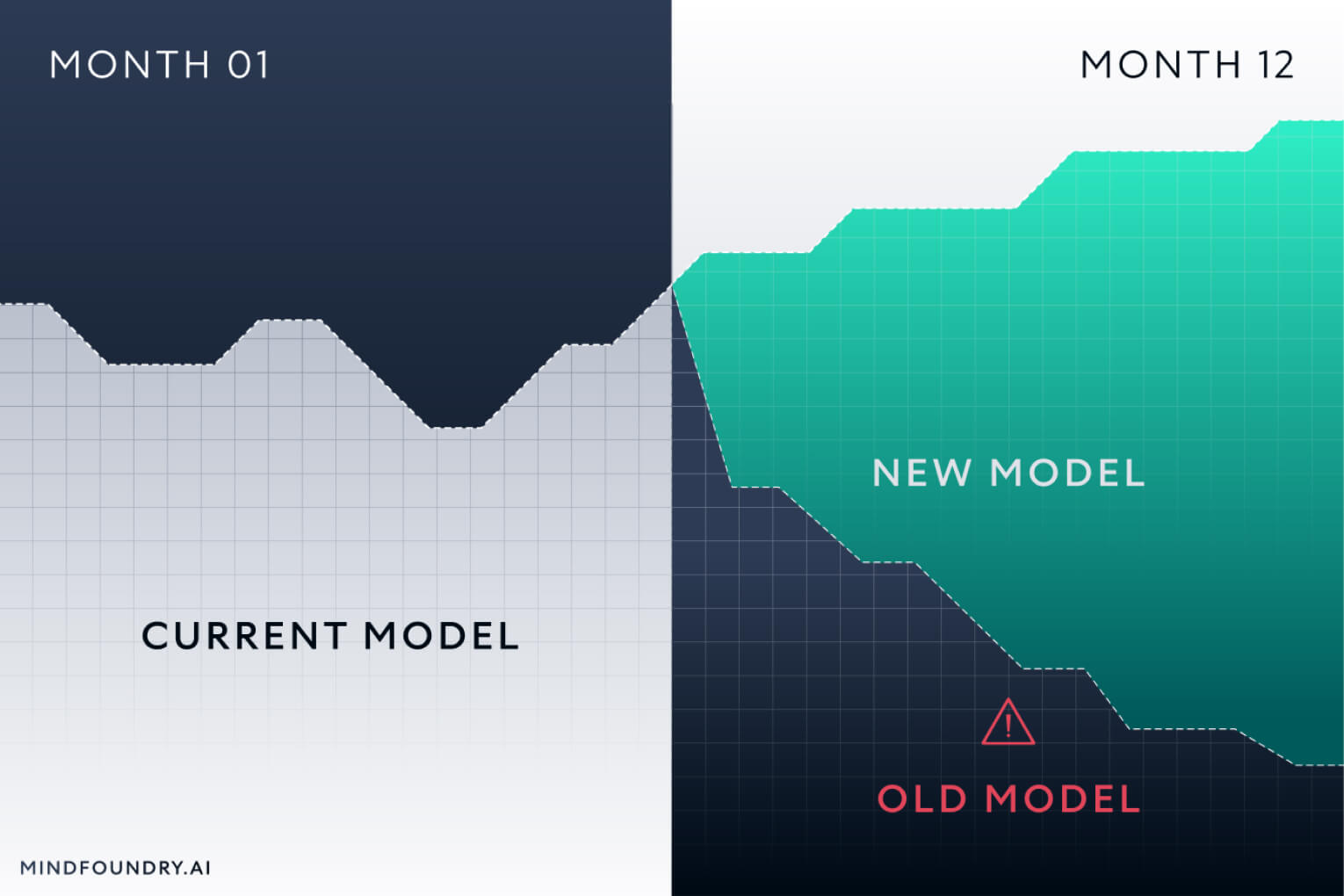

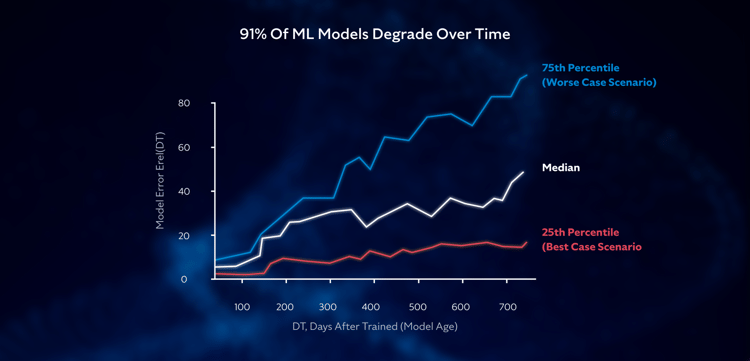

Moreover, the effectiveness of these models inevitably starts to degrade over time as the ever-changing market dynamics and customer preferences render them outdated and obsolete. For some, the sheer volume of AI models also creates a problematic lack of explainability and transparency, making it difficult to identify overlapping functions or inefficiencies and creating a disjointed and compartmentalised landscape of solutions. The issue of explainability is especially significant when considering the increasingly stringent regulations that many believe are just over the horizon, both for the insurance industry and AI as a technology.

New Challenges Require a New Approach

It has become painfully apparent in recent years that if you, as an insurer, have designs on making AI an integral component of your business, then you need to move beyond the patchwork of ad hoc AI models and transition to a more systematic approach to AI deployment and management. The escalating demand for unique, valuable models calls for a strategic shift in thinking in order to truly ensure AI's sustainable integration into the insurance industry.

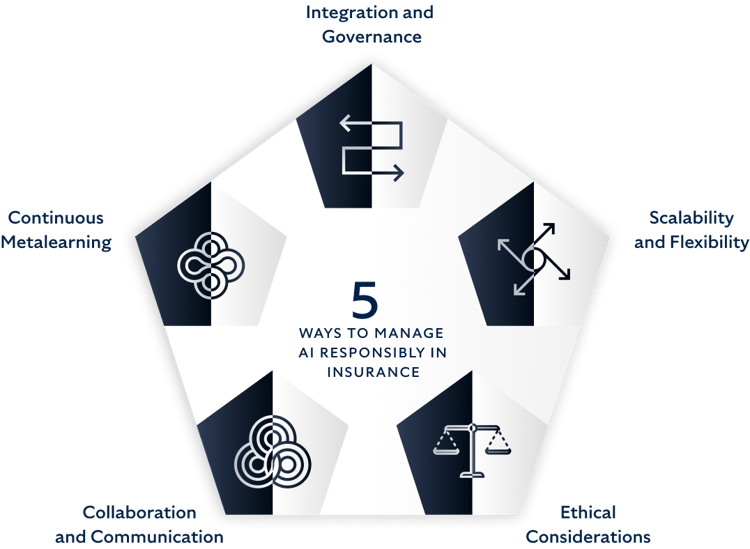

The key to overcoming these challenges is to invest in a comprehensive infrastructure that deploys AI models responsibly across the organisation while at the same time ensuring their continuous relevancy and performance through robust ML governance. By adopting a holistic AI model management solution, you can address all of the following aspects of AI adoption, but each will require its own strategic considerations:

Integration and Governance: Establish a centralised AI model governance framework to ensure coherence, consistency, and adherence to regulatory requirements. This framework should oversee the integration of AI models into the existing business processes, ensuring seamless collaboration between data science teams and business stakeholders.

Scalability and Flexibility: Adopt scalable AI platforms that can accommodate the increasing generation of data and cycle speed. This will enable insurers to swiftly respond to market demands and emerging opportunities, empowering them to make data-driven decisions at every stage of the insurance value chain.

Continuous Metalearning: Implement meta-learning strategies that enable AI models to continuously adapt and improve through self-learning. This approach ensures models remain relevant and effective amidst dynamic market conditions, enhancing model accuracy and reducing the risk of model decay.

Collaboration and Communication: Foster collaboration between data science teams, business stakeholders, and senior leaders to drive organisational learning. This approach has led to 73% of organisations experiencing significant financial benefits from AI, compared to the industry average of only 11%. Effective communication channels allow insights and knowledge to flow seamlessly, ensuring models are aligned with the organisation's strategic objectives and business goals.

Ethical Considerations: Emphasise the ethical use of AI models to build trust with customers and stakeholders. Insurers must be transparent about the data used and the underlying decision-making processes of AI models, ensuring responsible and fair practices that prioritise customer privacy and data protection.

The Solution for Scaling AI

Research has shown that 91% of models decay after the first year as new data is introduced, and the environment from which this data is collected continues to change. Keeping the models as performant as they were on day one of their deployment requires retraining or rebuilding, both of which incur significant costs to the business. But what if, as new patterns emerged, your models had the capability to retrain and improve their performance automatically? This type of capability is referred to as Continuous Metalearning, and it’s one of the capabilities provided by Mind Foundry Motion. Scaling AI throughout your organisation with models capable of Continuous Metalearning allows you to convert massive CapEx costs into very low OpEx costs.

To integrate AI into your business in a way that drives real business value, you will need a comprehensive portfolio of Continuous Metalearning models customised to perform a variety of functions across the organisation. You will also need to be able to manage all of these models effectively and efficiently, as well as build and integrate new ones as the opportunities arise. Initial AI adoption is just the first step; by scaling this adoption throughout your organisation, you can discover entirely new value streams. Partnering with someone who understands the potential pitfalls of this process and can help you overcome them is key. With a cohesive and integrated approach, you can stay ahead in a fiercely competitive market, delivering enhanced customer experiences and sustainable growth.

Enjoyed this article? Check out 'Insurance and Generative AI: Seeing Past the Headlines'

Unmanned Aircraft Systems (UAS) are now a staple of modern warfare, now responsible for 60% of targets destroyed in the Ukraine-Russia war....

In Defence and National Security, mission-critical data often emerges from a multitude of different sensor types. With AI, we can bring this...

When used by malicious actors or without considerations for transparency and responsibility, AI poses significant risks. Mind Foundry is working with...